Accounting for Innovation

“Welcome to Finance Transformation Times – One of the emerging newsletter followed by more than 12,000 Finance & Business Professionals globally for latest developments in Finance & Accounting”

As an unprecedented disruptive event, it’s no surprise that the COVID-19 pandemic has prompted all sorts of innovations. But did you know that by measuring and monitoring innovation, accountants / finance professionals can advise on how much value it contributes to an organisation, and help steer projects in the right direction?

In today’s article, I cover some key steps to measuring innovation, so you can boost your value as a trusted business advisor.

Measuring Innovation

For some people, the idea of measuring innovation is a misnomer. Yes, you can count the number of ideas people generate in a brainstorming session, or the financial return on a specific innovative project, but is either a true measure of the benefits delivered by innovation? Perhaps that’s why many organisations – even those that prioritise innovation – have no practical way of measuring innovation.

Though there are no standard metrics for keeping track of innovation, accountants can still take steps to monitor the investment in innovation and the level of innovation activities. You might evaluate the impact this work had, the nature of the innovation process and what was learned.

Let’s look at each of these approaches in turn.

1. Measure the Investment

The key question – how much time, money and other resources were invested in innovation activities or specific innovative ideas?

While this metric won’t record what has been achieved, it does demonstrate your commitment to innovation. This approach is commonly used by technological companies and governments – organisations who want to boast about their level of investment in research and development.

If you use this measure alone, there’s a risk you end up encouraging people to spend money or waste time, rather than focusing on delivering value through innovation.

2. Measure the level of Innovation

The key question – how many practical innovative ideas were generated?

This is more of a notional measure, which works well for longer-term innovation activities. For instance, a pharmaceutical company might measure how many patents it has registered, even if it isn’t currently developing products based on them.

Because this approach overlooks ideas that aren’t immediately practical, it can discourage any off-the-wall ideas when it’s not obvious how they will work in practice.

3. Measure the impact

The key question – did the innovation activity or specific innovative idea deliver any return on investment?

This is the most obvious and practical measure of success, and one that works particularly well for incremental innovation. For instance, if you introduce an upgraded product or service, you can measure whether this impacts your market share, customer satisfaction or profit.

This approach omits side benefits, though, such as what was learned during the process. It may also discourage risky or long-term ideas, because people feel they are required to deliver short-term profits.

4. Measure the Innovation Process

The key questions – how many people were involved? Which teams or disciplines were involved? How many ideas were linked with opportunities?

This measure focuses on how innovation is done and has the potential to capture intangible benefits – like increases in staff creativity. For instance, household appliance manufacturer Whirlpool conducts an annual census with employees, capturing information about how they have used innovation in their job.

This, of course, won’t show your investors the value all this creative thinking is delivering. But if you deliver a return on investment as well, they can’t complain!

5. Measure the learning

The key questions: What have we learned? Where will that learning lead us next?

This measure focuses on the most important side-benefit of innovation – learning. Even if an innovation fails to deliver a return on investment, it can – and should – deliver learning. Converting this learning into useful insights that may spark other innovations is the ideal outcome.

What’s the bottom line?

Every organization wants to innovate in one area or another, but those who measure and manage it successfully are the ones who really adds real value to their businesses.

Reference Used: Accounting cpd

If you are planning and willing to build these innovation management capabilities in your finance function as a part of performance management, then reach out to us at Hub of Finance Transformation Consulting and one of our expert advisors will get in touch with you via 30 mins free consultation call.

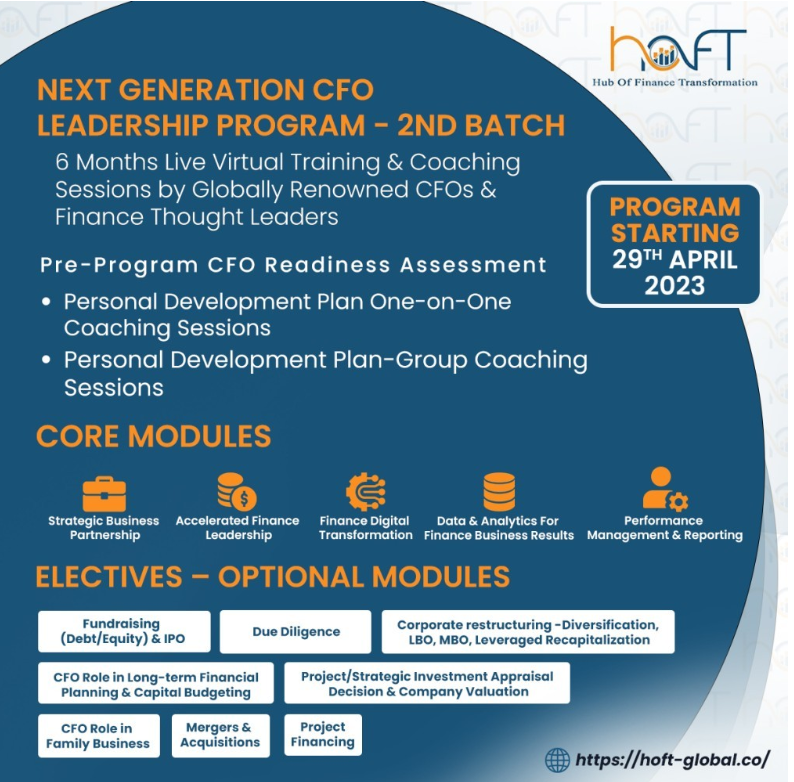

If you are willing to build Next Generation Finance Leader capabilities in yourself by transforming yourself into Next Generation CFO, then consider enrolling into our upcoming virtual training and coaching program starting 29th April 2023.

This into account only variable costs that rise or fall in line with the activity level. It can be used to inform short-term decision making in a way that absorption costing cannot.