GRC Risk Nucleaus

Elevate your Governance, Risk, and Compliance strategy with RiskNucleus Suite.

RiskNucleus® is a web-based, modular fully configurable and integrated application that streamlines the process of governance, risk and compliance management.

1. Solution ROI

Web-based modular system 🌍

Enhances governance, risk, and compliance management.

Quick implementation ⏱

Setup and deployment tailored for swift integration.

Comprehensive dashboards 📊

For intuitive data visualization and reporting.

Seamless integration 🔗

Ensures holistic risk management across platforms.

2. Value-added Service

RiskNucleus has empowered numerous organizations globally, offering tailored GRC solutions that streamline compliance, enhance risk management, and drive operational efficiency, significantly impacting ROI positively.

Prime example is Gulf International Bank (GIB) – Implemented operational risk management systems for enhanced governance and compliance.

3. Problem Solving in Business

RiskNucleus tackles critical GRC challenges, offering solutions that simplify compliance, enhance risk assessment, and ensure business continuity, thereby safeguarding organizational integrity and enhancing strategic decision-making.

4. Value in Numbers

BenchMatrix's RiskNucleus Suite simplifies GRC processes, offering quick deployment and extensive customization to meet diverse organizational needs, ensuring comprehensive governance, risk, and compliance management

100+

implemented systems

75+

satisified clients

5. Business Value

Through its adaptable and integrated GRC solutions, RiskNucleus Suite delivers significant business value by providing robust risk management, ensuring compliance, and enhancing operational efficiency.

Governance, Risk & Compliance

Enterprise Risk Management

Loan Origination System

Anti-Money Laundering

Banking Solutions

- Operational Risk Management

- Regulatory Compliance Management

- Business Continuity Management

- IT Risk Management

- Audit Management System

- Third Party Risk Assessment

- Corporate Governance – Policies & Procedures

- Risk Appetite Framework

- Learning Management System

- Capital Adequacy Ratio

- Liquidity Standards Reporting

- ECL Calculator

- Corporate Loan Origination

- Consumer Loan Origination

- Watchlist Screening

- Customer Risk Assessment

- Transaction Monitoring

- Branch Banking

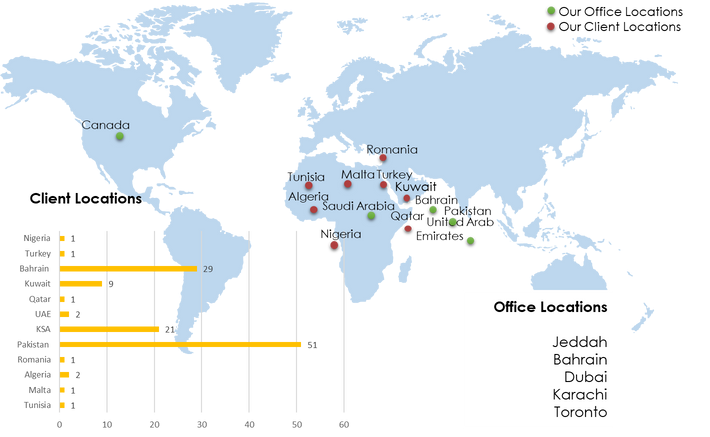

OUR OFFICES & CLIENT LOCATIONS

Standardize designs across different pages!

After choosing pages across multiple templates, click on the element whose style you prefer, click the ‘copy style’ icon on the top-right corner of your screen, and use the icon to click on the element you want to change! Ta-da! The elements now share the same style.

Clients