FRACTIONAL CFO SERVICES

ABOUT PI HOFT&

Our Fractional CFO / Virtual CFO Services provide growing companies with access to high-level financial expertise on a flexible, part-time basis.

Whether you need strategic financial guidance, enhanced reporting, or support for a specific financial initiative, our seasoned CFOs integrate seamlessly into your organization to drive performance, improve profitability, and ensure long-term growth.

Leveraging cutting-edge digital technologies for data analytics and reporting, we deliver real-time insights and tailored financial strategies to meet your unique business needs.

Global Expertise, Local Impact

Your Fractional CFO Partner Worldwide

At PI HOFT&, we redefine financial leadership by offering unparalleled fractional CFO services across diverse industries in the UK, Australia, UAE, and

Switzerland.

Our team of seasoned fractional CFOs delivers innovative solutions tailored to your business needs, driving success and client satisfaction

beyond borders. Discover how our global expertise can transform your financial landscape and propel your business towards extraordinary growth and

profitability.

What we offer…

PI HOFT also provides tailored BPO services for Accounting, Bookkeeping, and Finance functions, complementing our Fractional and Virtual CFO expertise, fueling efficiency and business growth

-

Strategic Financial Planning,

-

Cash Flow & Working Capital

Management

-

Financial Reporting & Data

Analytics

-

Financial Controls &

Compliance

-

Capital Raising & Investor

Relations

-

Merger & Acquisition

Key Services & Methodologies

01 - Strategic Financial Planning, Forecasting and Modeling

Our Methodology

Financial Strategy

We conduct a deep dive into your current financials, identifying opportunities and risks aligned with your business strategy.

Data-Driven Forecasting

Using advanced analytics, we build rolling forecasts to anticipate

revenue streams, cost structures, and capital needs.

Scenario Planning

We evaluate multiple financial scenarios, assessing potential outcomes under various economic and operational conditions.

Budgeting & Resource Allocation

We assist in setting budgets, allocating resources efficiently, and aligning them with your strategic goals.

Financial Modeling

Plays a key role in decision-making by delivering accurate projections,

scenario analysis, and insights for informed strategic choices.

02 - Cash Flow & Working Capital Management

Our Methodology

Cash Flow Forecasting

We develop cash flow forecasts based on historical data and forward-looking projections to identify cash surpluses or shortages.

Working Capital Optimization

We evaluate and implement best practices for managing inventory, receivables, and payables, reducing your cash conversion cycle.

Cost Control Initiatives

We identify cost-saving opportunities and implement strategies to reduce expenses without compromising growth.

Cash Reserve Planning

We help build and maintain appropriate cash reserves to ensure operational stability and flexibility in times of uncertainty.

03 - Financial Reporting & Data Analytics

Our Methodology

KPI Development

We identify and implement Key Performance Indicators (KPIs) that align with your business objectives, providing a clear picture of your financial health.

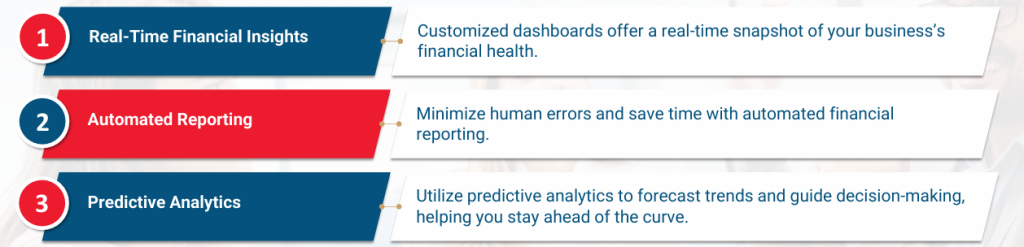

Customized Dashboards

Leveraging cloud-based tools, we create interactive dashboards that offer a real-time view of critical financial metrics.

Automation of Financial Reporting

We automate your financial reporting processes, reducing manual input errors

and improving speed and accuracy.

Data Analytics & Visualization

We use sophisticated data analytics tools to turn raw data into insights, identifying trends, anomalies, and opportunities for improvement.

04 - Financial Controls & Compliance

Our Methodology

Risk Assessment

We perform a comprehensive risk analysis of your current financial control environment to identify weaknesses and gaps.

Internal Controls Development

We design and implement internal controls that align with best practices and industry standards, ensuring your business is protected from fraud and operational inefficiencies.

Regulatory Compliance Review

We ensure that your financial reporting and

procedures comply with local, national, and

international regulations, reducing exposure to fines and penalties.

Ongoing Monitoring & Reporting

We provide ongoing oversight to ensure controls are functioning as intended and make adjustments as needed.

05 - Capital Raising & Investor Relations

Our Methodology

Funding Strategy Development

We assess your financial needs and help you identify the right capital-raising options, whether it’s debt, equity, or alternative financing.

Investor Communications

We create clear, compelling presentations and reports to keep investors informed and engaged.

Valuation & Financial Projections

We prepare robust financial models and valuation reports to support your fundraising efforts, ensuring transparency and confidence for investors.

Investor Relations Support

We provide ongoing support in managing investor expectations and maintaining strong relationships through regular updates and transparent reporting.

06 - Merger and Acquisition

Our Methodology

Strategic Planning

We begin by understanding your growth objectives, evaluating industry trends, and mapping potential targets or buyers.

Target Screening

Using both quantitative and qualitative criteria, we screen and prioritize potential opportunities, ensuring they align with your

business objectives.

Valuation & Deal Structuring

We perform a rigorous financial analysis to ensure fair valuation and structure deals in a way that optimizes tax, regulatory, and financial outcomes.

Negotiation & Execution

We manage negotiations, conduct transaction documentation, and ensure regulatory compliance.

Post-Merger Integration

Our post-merger services focus on integrating operations, systems, and cultures for long-term success.

Our Unique Value Proposition

Use of Digital Technologies for Data Analytics & Reporting

We leverage advanced technologies such as cloud-based financial platforms, AI-powered analytics tools, and automation software to streamline your financial processes. Our tech-enabled

approach provides:

Diversified Industry Expertise

Our team of fractional CFOs has deep experience across multiple industries, including:

• Technology & SaaS

• Healthcare & Life Sciences

• Manufacturing & Supply Chain

• E-commerce & Retail

• Financial Services & Fintech

• Real Estate & Construction

• Professional Services

This broad industry expertise ensures that we can tailor our services to meet the specific financial challenges and regulatory requirements of your industry, providing you with insights and strategies that deliver results.

Flexible Engagement Model

Our Fractional CFO services are designed to offer the financial expertise you need without the commitment or cost of a full time hire. Whether you need short-term support for a specific project or ongoing guidance, we provide flexible, part time engagements that align with your business needs.

Growth-Focused Strategy

We don’t just manage your numbers—we actively help drive growth. Our CFOs focus on building scalable financial strategies that support your company’s expansion and profitability, ensuring long-term sustainability.

Why Choose Us?

Let us provide the financial leadership you need to accelerate your growth

and achieve your business goals.

Seasoned CFOs with Diverse Expertise

Our CFOs have decades of experience across multiple industries, ensuring you get insights that are relevant to your business.

Technology Driven Digital Solutions

We provide flexible, part time CFO solutions that can scale with your business.

Scalable & Flexible

We use the latest digital tools for financial reporting and analytics, providing you with real-time insights.

Growth & Profitability Focused

We are more than just number crunchers; we are strategic partners committed to helping you grow and improve profitability.

Our Case Study

Driving Financial Success for a Pharmaceutical Startup through Fractional Virtual CFO Services

Location: Switzerland

Development Phase: Startup

Our client, a promising pharmaceutical startup in Switzerland, was at a critical growth stage where financial expertise was essential for navigating complex challenges and capitalizing on opportunities in the market. With aspirations to expand operations, develop innovative products, and attract investors, they sought our tailored CFO services to drive financial success and strategic decision-making.

Fractional CFO Services for a Well-Established F&B Group

Location: UAE

Development Phase: Established Group

Elhaam Investment Group is a leading hospitality company based in Abu Dhabi. With over 15 years of experience, they specialize in chocolate production, restaurants, and catering services. Their innovative approach has earned them a prestigious clientele, including royal families and government offices.

Fractional Financial Planning Services for a Piping Manufacturer Plant

Location: Australia

Development Phase: Established Group

Our client is an established piping manufacturer

plant based in Australia.

They have been in operation for over a decade

and have a strong presence in the market, with a

focus on delivering high-quality piping solutions

to various industries.

Fractional CFO Services for a Copper Mining Startup

Location: United Kingdom

Development Phase: Startup

Our client is a startup company based in the UK

operating in copper mining trading and

investment.

They were looking to establish a strong financial

foundation and streamline their financial

processes to attract investors and ensure

sustainable growth.

Elevate your financial strategy with our fractional CFO expertise. Reach out to us for strategic financial leadership tailored to your needs

Feel free to contact us and one of our expert advisor will get in touch with you shortly.