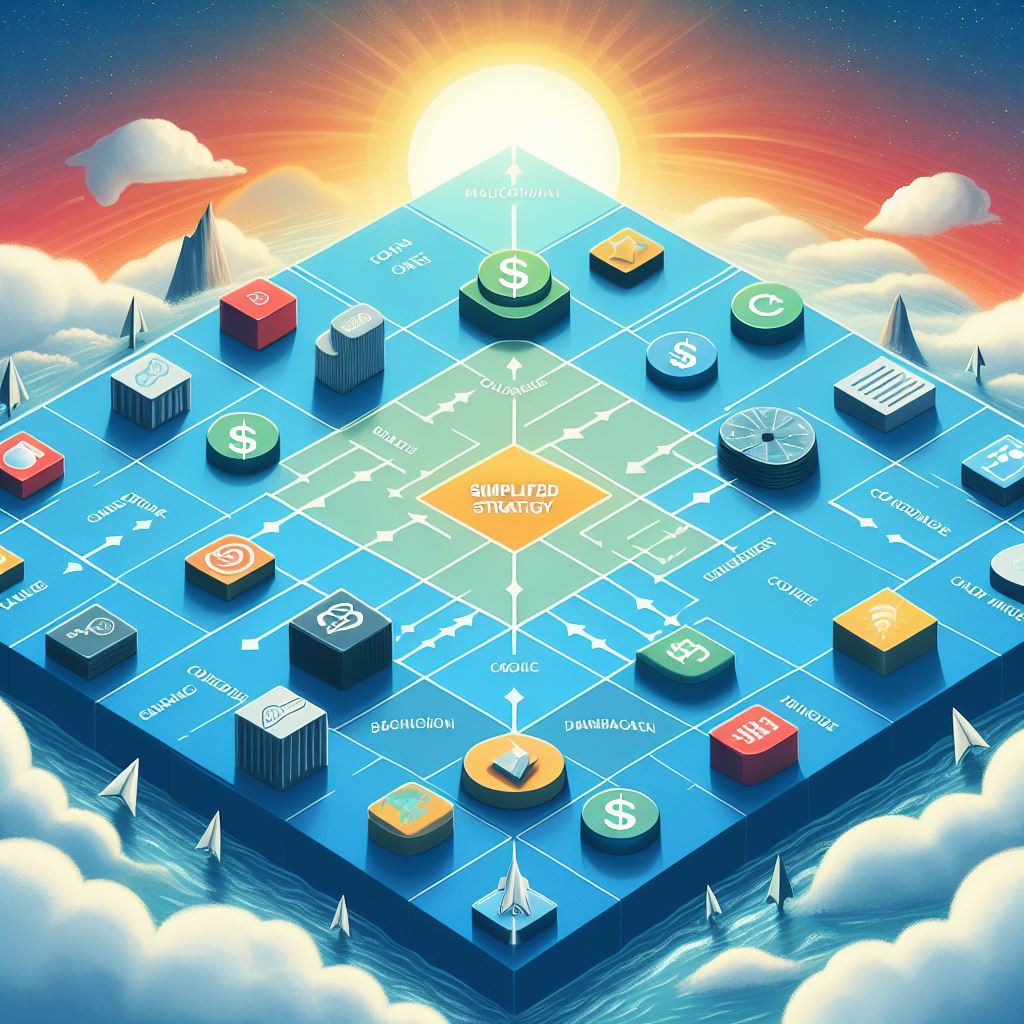

As a CFO or FP&A it’s important to assess your company’s product lines regularly to see which product is profitable, which is making losses, and which ones need some work. Also, you will need to know how the cash resources can be allocated properly among different products to maximize the company’s future growth and profitability.

So, one of the best strategy tools supports that purpose is the BCG Matrix.

The BCG Matrix is a strategy tool which produces a framework for allocating resources among different products and makes it possible to compare the product portfolio briefly, and it helps you to screen the opportunities quickly and simply and to think about how you can make the most of them.

The BCG Matrix classifies the company’s business units / products into four categories based on the combination of their market growth and market share relative to the next best competitor. The four categories are:

♦ Stars

♦ Cash Cows

♦ Question Marks

♦ Dogs

It is based on the combination of market growth and market share relative to the next best competitor.

Stars - High Growth, High Market Share

Star units are leaders in the category. These products have a significant market share; hence they bring the most cash to the business, and a high growth potential that can be used to increase further cash inflow.

Cash Caws - Low Growth, High Market Share

Cash cows are products with significant ROI but operating in a matured market which lacks innovation and growth. These products generate more cash than it consumes.

Usually, these products finance other activities in progress (including stars and question marks).

Question Marks - High Growth, Low Market Share

Question marks have high growth potential but a low market share which makes their future potential to be doubtful.

Since the growth rate is high here, with the right strategies and investments, they can become stars. But they have a low market share so wrong investments can downgrade them to Dogs even after lots of investment.

Dogs - Low Growth, Low Market Share

Dogs hold a low market share and operate in a market with a low growth rate. In general, they are not worth investing in because they generate low or negative cash returns and may require large sums of money to support. Due to low market share, these products face cost disadvantages.